Frequency Product Market Update - August 2022

3 Aug 2022

EMILY RUSHTON - MARKETING

What major changes have taken place within the crystal industry since the covid pandemic?

The frequency products marketplace has been through a storm of issues since 2020 that have affected the availability, price and lead time of frequency products. These issues began with factory shutdowns due to the Covid pandemic, which caused immediate major industry disruption.

Shortages caused by shutdowns were then exacerbated by further problems, some of which affected specific sectors of the industry as they impacted specific geographies. A drought in Taiwan for instance led to factories being unable to manufacture parts using the water-intensive process required to produce and cut quartz crystals which caused all Taiwanese products to become scarcer.

Then in October 2020 a devastating fire at the Asahi Kasei Corporation factory in Japan which had previously produced over 80% of ICs used in the global supply of higher performance temperature compensated oscillators (TCXOs) caused huge shortages in the TCXO sector. Most recently the Ukraine-Russia conflict, in addition to being a terrible humanitarian crisis, is beginning to cause shortages of the rare metals needed to produce component packages.

All of these shortage situations meant that, as our Product Manager Nigel Cole describes, we moved from a ‘just-in-time’ marketplace, to a ‘just-in-case’ marketplace where customer demand began to far outstrip supply as customers purchased stocks ‘just-in-case’ they needed them. Although the marketplace is beginning to recover from these supply shocks, many suppliers have reacted to these problems by prioritising manufacturing lines for popular frequency products, causing an uneven recovery.

How are lead times for crystals & oscillators currently?

Search our range of 32.768kHz here, many of which have recovered lead times to pre-pandemic levels

Avoid supply shortages by searching our range of 7x5mm oscillators here

The lead time recovery is patchy and differs widely dependant on package size, product popularity, and IC type. Some watch crystal lead times are recovering quite quickly: the popular 3215 package size is back to 8-10 weeks lead time again. However smaller sizes watch crystals are still around 30 weeks. Many TCXOs are also in the process of recovering their lead times, shorter than 16 weeks is now common, but CMOS TCXOs are negatively impacted by a severe shortage of specific ICs and are therefore on allocation. SAW filters have also recovered well and are typically less than 19 weeks for volume orders.

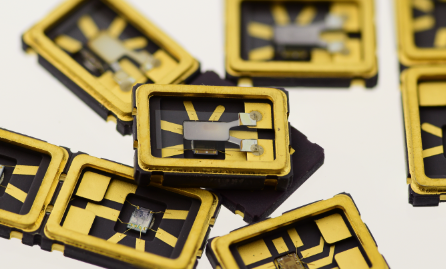

Standard oscillator lead times are very variable however, with wait times being heavily IC manufacturer dependant. There is a shortage of LVDS ICs meaning you can expect a 25+ weeks lead time for some of the higher frequencies and supply voltages for a LVDS oscillator. However standard industrial oscillators should have much shorter lead times. In addition to the LVDS shortage, many 7x5mm packages are also in short supply due to ceramic supplier Kyocera pulling out of the international ceramic market for 7x5mm packages.

Kyocera are still supplying to their home Japanese market and therefore Golledge are still able to supply through our Japanese manufacturer, however there is a general shortage of 7x5mm oscillators at present.

In addition to recovering lead times, prices are also reducing as the supply-demand balance rights itself. Consequently you can expect those products with recovered lead times to have reduced prices compared with those that are still experiencing shortages. New volume orders for TCXOs can show significant cost reductions for instance.

So what's our most up-to-date sourcing advice?

There are still some issues with supply in the frequency market and therefore forecasts are still key. Our expert team are much better able to meet the needs of those customers who can give us even a rough 12 month forecast. In a similar vein some suppliers, including Golledge, are also able to offer buffer stock agreements, which help you to meet the ‘just-in-case’ demand whilst not holding stock on-site. If this would be of interest our team are always happy to discuss further, you can get in touch by emailing sales@golledge.com. In general we would advise that approving a second source for your projects is a wise move to increase resilience. Golledge are able to offer dual component sourcing without needing to approve a second supplier, and as a part of the Techpoint group we are also able to offer manufacturing and prototyping expertise. If you need to approve a second supplier for your components it helps to source from those with added value.